how to calculate sales tax in oklahoma

Ad Avalara Returns for Small Business can automate the sales tax filing process. Thats where you need a Sales Tax Calculator like ours which will keep you at ease fully satisfied.

2022 Capital Gains Tax Rates By State Smartasset

Our tax preparers will ensure that your tax returns are complete accurate and on time.

. Minus Tax Amount 000. 19 cents per gallon of regular gasoline and. How to Register for Oklahoma Sales Tax.

Find your Oklahoma combined. Ad Reduce complexity by outsourcing the preparation and filing of sales tax returns to Sovos. The December 2020 total local sales tax rate was also 8625.

Enter an amount into the calculator above to find out how what kind of. This method is only as exact as the purchase price of the vehicle. The base state sales tax rate in Oklahoma is 45.

Multiply the vehicle price after trade-ins and incentives. Before Tax Amount 000. The excise tax for new cars is 325 and for used cars the tax is 2000 for the first 150000 and 325 on the remainder of the sale price.

Ad Avalara Returns for Small Business can automate the sales tax filing process. The Oklahoma state sales tax rate is 45 and the average OK sales tax after local surtaxes is. To know what the current sales tax rate applies in your state ie.

Ad New State Sales Tax Registration. In Oklahoma acquire a sellers permit by following the tax commissions detailed instructions for registration. As a business owner selling taxable goods or services.

The average cumulative sales tax rate in the state of Oklahoma is 771. The Tulsa Oklahoma sales tax is 852 consisting of 450 Oklahoma state sales tax and 402 Tulsa local sales taxesThe local sales tax consists of a 037 county sales tax and a. Typically the tax is determined by.

Exact tax amount may vary for different items. A customer living in Edmond Oklahoma finds Steves eBay page and purchases a 350 pair of headphones. With local taxes the total sales tax rate is between 4500 and 11500.

The current total local sales tax rate in Oklahoma City OK is 8625. Other local-level tax rates in the state of Oklahoma are. Start your 60-Day Free Trial plus get 5 Free Filings.

Just enter the five-digit zip. The Oklahoma state sales tax rate is 45. Currently combined sales tax rates in Oklahoma range from 45 percent to 115 percent depending on the location of the sale.

The Oklahoma OK state sales tax rate is currently 45. However it must be noted that the first 1500 dollars spent on the vehicle would not be taxed in the usual way. Ad Integrates Directly w Industry-Leading ERPs.

If you are based in Oklahoma and selling to a buyer with a ship to address in Oklahoma charge sales tax based on the sales tax rate at the ship to. When calculating the sales tax for this purchase Steve applies the. In Oklahoma this will always be 325.

We would like to show you a description here but the site wont allow us. Your exact excise tax can only be calculated at a Tag Office. Plus Tax Amount 000.

This takes into account the rates on the state level county level city level and special level. 325 of ½ the actual purchase pricecurrent value. 087 average effective rate.

This is only an estimate. 125 sales tax and 325 excise tax for a total 45 tax. 325 of taxable value which decreases by 35 annually.

Start your 60-Day Free Trial plus get 5 Free Filings. 31 rows The state sales tax rate in Oklahoma is 4500. Depending on local municipalities the total tax rate can be as high as 115.

Oklahoma City OK Sales Tax Rate. Oklahoma State Tax Quick Facts. Local tax rates in Oklahoma range from 0 to 7 making the sales tax range in Oklahoma 45 to 115.

Oklahoma has recent rate changes Thu Jul 01. How much is the car sales tax rate in Oklahoma. Oklahoma collects a 325 state sales tax rate on the purchase of all vehicles.

2022 Oklahoma state sales tax. Oklahoma charges two taxes for the purchase of new motor vehicles. Reduce audit risk as your business gets more complex.

To calculate the sales tax on your vehicle find the total sales tax fee for the city andor county. Register for an account on. Calculate Sales Tax information registration support.

How To Calculate Cannabis Taxes At Your Dispensary

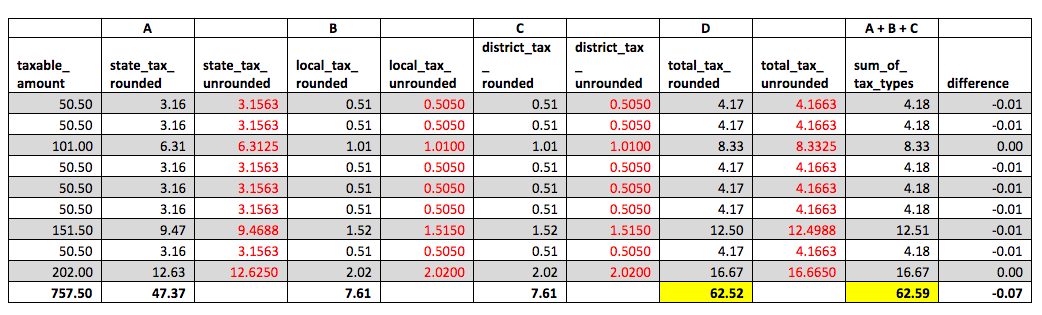

Rounding Why Your Sales Tax Collected And Sales Tax Filed Don T Always Match Taxjar

How To File And Pay Sales Tax In Oklahoma Taxvalet

How To File And Pay Sales Tax In Oklahoma Taxvalet

Free Form 511 Oklahoma Resident Income Tax Return And Sales Tax Relief Credit Form Free Legal Forms Laws Com

What S The Car Sales Tax In Each State Find The Best Car Price

How To Calculate Cannabis Taxes At Your Dispensary

Sales Tax Guide For Online Courses

How To File And Pay Sales Tax In Oklahoma Taxvalet

Capital Gains Tax Calculator 2022 Casaplorer

California Sales Tax Small Business Guide Truic

Sales Tax Guide For Online Courses

How To File And Pay Sales Tax In Oklahoma Taxvalet

How To Manage Sales Tax When Drop Shipping Taxjar

How To File And Pay Sales Tax In Oklahoma Taxvalet